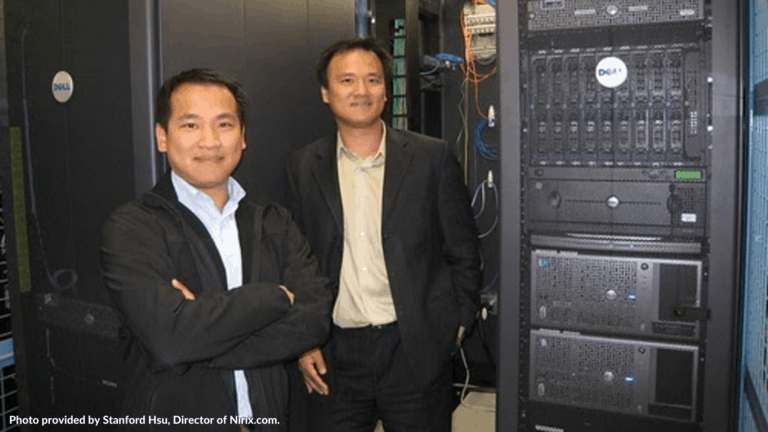

When evaluating the benefits of government funding and other financing sources, Stanford Hsu, Co-founder of NIRIX, shares some insights into the process of leveraging the multiple programs available for startups and mature companies alike. In the early 2000s, NIRIX was one of the few Cloud Computing service providers in Western Canada. Facing competition with still nascent Amazon AWS and Microsoft Azure, Stanford was able to leverage more than $1.6M in Federal and Provincial Innovation Grants. Looking back on their experience, Stanford believes having a balanced funding strategy could have been even more helpful in their endeavor to grow their business.

Coopetition as the strategy

From 2006 to 2008, Microsoft invited partners including NIRIX to quarterly sessions in Seattle to discuss emerging trends and cloud computing strategies.

“By joining those sessions, I knew we were feeding a monster that can compete with us. However, as a small company, we had little budget to educate the market. We thought it was better for Microsoft to invest in market education and we took advantage of the trend.” Stanford recalls.

All the while, NIRIX acquired more than 600 clients for their cloud platform and secured a partnership with Rogers Data Center as their hosting partner. In 2010, Microsoft launched Azure.

External Funding

As an emerging fast-growing company, NIRIX’s team started searching for external funding.

“At the time, we were not planning to onboard a VC as there were not many early stage VCs available in Canada.”

In 2007, Stanford started building relationships with SR&ED and the grant’s representative. “We had to meet almost 8 times with SR&ED funding advisors until we were taken seriously. We simply didn’t know what information to prepare!”

As NIRIX built their credentials with various funding agencies, over time, the company constantly received an average of 200K-300K non-dilutive funding annually.

“We are very appreciative of the fund advisors who held our hand throughout the process and led us to other funding sources such as NRC-IRAP, Alberta Innovates, TECTERRA, BCIP, and the Western Diversification Fund.”

Priority & Balance

When asked how to use limited amounts of time to cover the operation, sales, and preparation for grant funding, Stanford said: “My co-founder took care of sales and I took care of operations and other funding sources. We exchanged notes on completing grant work outside normal working hours. Every cash generating activity from grants to debt and equity financing has to run in parallel with sales. You gotta do what you have to do if you want to stay competitive. Raising capital can require a large commitment.”

About prioritizing financing sources, Stanford said:

“The information required for the grant due diligence process is largely the same information required when you go out to raise any type of funding - debt or equity. The preparation work is transferable. In our experience, on balance, the big difference between public sector money and private sector is the approval process and the timing. Private investors may have faster decision cycle times than the government, so you should be prepared for enough runway.”

As Stanford embarks on his next venture, he believes his past experience is invaluable.

“As an entrepreneur, it would be foolish to not take advantage of the government funding programs. If you qualify for it, it's low cost non-dilutive money. It’s great to get you off the ground in facing competition and R&D activities. I believe we should have moved even faster. If I could go back, I would have taken grant funding under my belt as soon as possible and leverage private sector money such as debt and venture capital to accelerate growth.”

Stanford’s Secret Resource for Grants:

General Resource for Alberta companies

For Research & Development stage :

For Commercialization stage :

For Scale-up and Hiring:

Innovative Solution (formally BCIP)

If you aren’t familiar with the basics of the SR&ED program, you might want to take a look at our SR&ED Tax Credits and IRAP Grants Explained article.

Disclaimer: Any views or opinions are not intended to malign any religion, ethnic group, club, organization, company, or individual. All content provided on this blog is for informational purposes only.